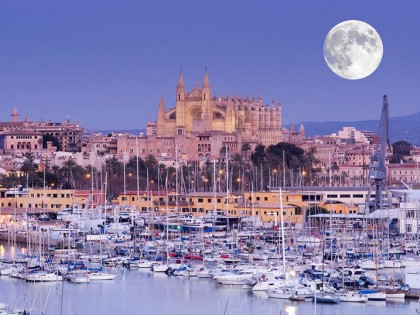

There is no doubt about it: buying a home is one of the most complex processes we will ever face in life, especially in Mallorca menor and Ibiza.

It must be a very well thought-out decision, because of all that the gesture means: betting on a place to live and, of course, facing a great economic investment. Which for many will require applying for a mortgage.

But do you know everything about mortgages?

Here we’ll go over some basic tips to understand some important concepts about mortgages in Mallorca, Menorca & Ibiza. This way, you will be able to face the application process with certainty that you know what you want and how to get it..

The legal situation of the property

The first thing we recommend before starting to look for and inquire about mortgages is to do some research about the legal situation of the property. This is a good way of avoiding unforeseen events. The first thing to do is to go to the nearest land registry office in the province. If you do not know where to go, go to the page of the Association of Property Registrars to locate the nearest office.

Don’t skimp on time and effort

Mortgage loans can accompany us for many years. Twenty or even thirty. That’s why it’s very important that you take the time to study all the options. Invest hours and days to get to know all the concepts in depth, because otherwise you might end up regretting them.

The percentage of financing

There are very few entities today that finance 100% of a mortgage. The final percentage that each bank finances may vary, so it is very important to discuss with the bank our situation and all these extremes. Some entities can finance up to 80%, but check before to have a certain figure on the table.

Fixed or variable interest rate

Lately there is a lot of talk about fixed or variable interest. You should know, for a start, that fixed-rate mortgages are loans whose repayments do not vary over time. Variable rate mortgages, on the other hand, are reviewed every year and are calculated on the basis of the reference index, which is usually the Euribor. As a disadvantage, it should be noted that the former have higher interest rates, although the mortgagee will always be certain of paying a fixed instalment.

Linked products

It is very common for banks to offer linked or associated products which can influence the interest rate on your mortgage. The bank can’t force you to contract them, even if it means a reduction in the fee. In any case, make sure you know the products associated with the mortgage in depth.

Comisiones

The commissions are a separate chapter in the mortgage negotiation. When signing a mortgage loan, you’ll be faced with a series of commissions, which may be those for opening or total or partial repayment of the loan.

Weighing up your options

Besides being very clear that you want to buy the house or the apartment you like in Mallorca, Menorca and Ibiza, in the right location and for the price offered, once you know all the concepts to handle in the signing of a mortgage, you should really think about it. Committing to paying the mortgage is, in most cases, a decision that will take many years. Weigh up your financial situation very carefully and be clear about whether it can change in the long term.

Put all the advantages and disadvantages on a scale. Plan the management of your savings and review all the proposals you have on the table. Don’t miss any detail.

Should you require any assistance or legal counsel concerning properties, purchases and sales on the islands of Mallorca, Menorca and Ibiza, please contact us at your convenience at info@mallorcasolicitors.co.uk or by phone on the numbers listed on our contact page.