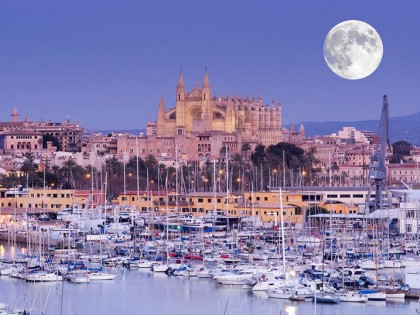

If the gorgeous Spanish summers have convinced you to invest in a property abroad, Mallorca is a fantastic place to start. With its clear beaches and fantastic culture, the property prices are relatively affordable, and will give you a second home in return where you can escape to now and then, rent out, or even retire. A large part of the house purchasing process is finding mortgage brokers who offer the most budget friendly rates.

What Does Secondary Residence Mean?

When you are renting or buying a house, you can only have one primary residence for tax purposes. Therefore a secondary residence is classed as any other housing you own or rent.

Characteristics of a mortgage for a second residence

The mortgage for second residence, although it is constituted the same as when it is for habitual residence, has different characteristics that are determined both from the point of view of demand, the supply of financial institutions and the risk of these type of operations:

Their demand is lower, since the population group they are targeting is much smaller than that looking for a regular home.

The financial effort may be more important if the applicant still has pending payments for the purchase of their primary residence.

Many of the second-home areas, especially on the coasts, tend to have less stable prices, rise more rapidly in good times and fall sharply when the opposite occurs. All of this carries a greater risk, and Spanish lenders may take advantage of the property value trends.

These points, smaller market and more risk, determine those different characteristics that second home mortgages have compared to the one that finances the habitual residence:

The higher interest rates, which are reflected in the more expensive fixed rate loans and in higher spreads in the variables.

Maximum amount to finance lower. If the average percentage in the first home is 80%, in mortgages for the second residence it is reduced to 50-70%.

Shorter terms. The same as in the previous case, if the most usual average term for a first home mortgage is between 25 to 30 years, in the case of the second it is reduced to below 20 years.

High financial effort as a result of higher rates and shorter terms means that, although the price of the house is lower than a habitual residence in a big city, the financial effort is higher. To this must be added that they have to contribute more money to pay the percentage of the value of the sale that is not financed with the mortgage.

What to take into account when contracting a second residence mortgage in Mallorca

With the above characteristics of the Spanish property market and imbalance in property value, offers from mortgage lenders may be limited and provide more expensive financing. Therefore, it is important to find the cheapest alternatives, although each alternative has points for and against. Your mortgage approval will also depend on your current situation such as:

If you have finished paying your mortgage for your habitual residence or you do not have:

You can apply for a secured mortgage on the second home you are going to buy.

You can choose to offer it as collateral paid residence. In this case, you can get better conditions such as lower mortgage repayments, but in exchange for offering the home in which you reside as a guarantee again, thus assuming a higher risk in the event of default than if you do so with the second home.

If you do not finish paying your first residence:

Apply for the second home mortgage, taking into account the characteristics that we have indicated and that is made more complex by the ceiling of loan expenses with respect to income, which as a general rule should not exceed a third of the total.

You can extend your current mortgage, but in this case the financing limit is set by the value of the habitual residence and the amount pending amortisation and not the value of the house you are going to buy.

All this must be transferred when looking for a mortgage for a second residence in which you have to analyse the offer very well, look for the most beneficial option and negotiate to get the best conditions. Thus, for example, not having an amortisation commission, partial or total, is even more important to be able to anticipate payments when financial circumstances change.

Bank-owned home mortgages also come into play. Financial entities that still have a significant stock of vacation homes “play in their favour” by offering better conditions for their properties in a segment that, as we have seen, is more expensive to finance.

All these factors must be analysed to get the second home at the best price and with a second home mortgage with the most beneficial conditions. Feel free to use this mortgage calculator so you can have a clearer idea of your budget and the interest rate you’d pay on your Spanish mortgage.